James F. Downes and Mathew Wong re-evaluate the impact of the Belt and Road Initiative by examining important macroeconomic linkages between China and other economies. Combining statistical analyses of 163 countries, alongside EU case studies, they find that the economic impact of the BRI is limited, and determined largely by pre-BRI economic factors

China's vastly ambitious Belt and Road Initiative, or BRI, was launched by President Xi Jinping in 2013. It has now been in force for eleven years. The project aimed big, seeking to boost trade, infrastructure and investment across Asia, Africa, and Europe.

But how much do we really know about the BRI's real-world impact, economically and politically? Our new study in the Chinese Journal of Political Science aims to provide a clearer picture. Via a comprehensive analysis of 163 countries, from 1999–2017, we have re-evaluated the overall outcome of the project.

Xi Jinping's Belt and Road initiative aimed big, seeking to boost trade, infrastructure and investment across Asia, Africa and Europe

Our research draws on a wide range of macro-economic and political variables. These include investment turnovers, imports to China, and exports from China, alongside GDP, oil, foreign direct investment, democracy scores, corruption levels, and other control variables.

We divided the 163 countries in our analysis into three groups:

Our study reveals two key findings. Firstly, BRI's arrangement is determined by China’s pre-existing connections with other economies, prior to 2013. Secondly, it reveals that the impact of the BRI is limited once we take pre-BRI economic trends into account. The partial exception is Chinese investments flowing exclusively to formal participants.

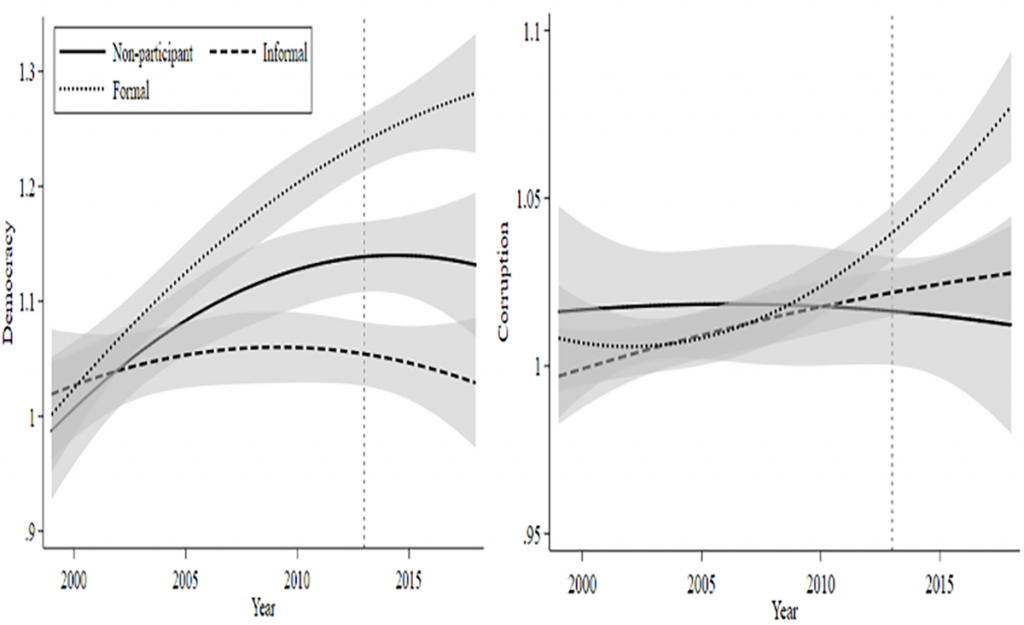

The 'Trends of democracy and corruption' graph below analyses the political correlates of BRI participation. It shows trends in democracy and corruption in countries grouped by BRI participation. Formal BRI participants tend to be more democratic over time, followed by non-participants to a lesser extent. Yet this trend did not emerge after the BRI; nor did the onset of the BRI alter their trajectories.

Corruption trends also follow a surprising pattern. Formal participants’ level of corruption has improved over time, whereas informal and non-participants' corruption levels remain largely unchanged. These observations provide preliminary evidence that the BRI does not 'export' authoritarianism, and BRI participants do not experience more severe corruption levels overall.

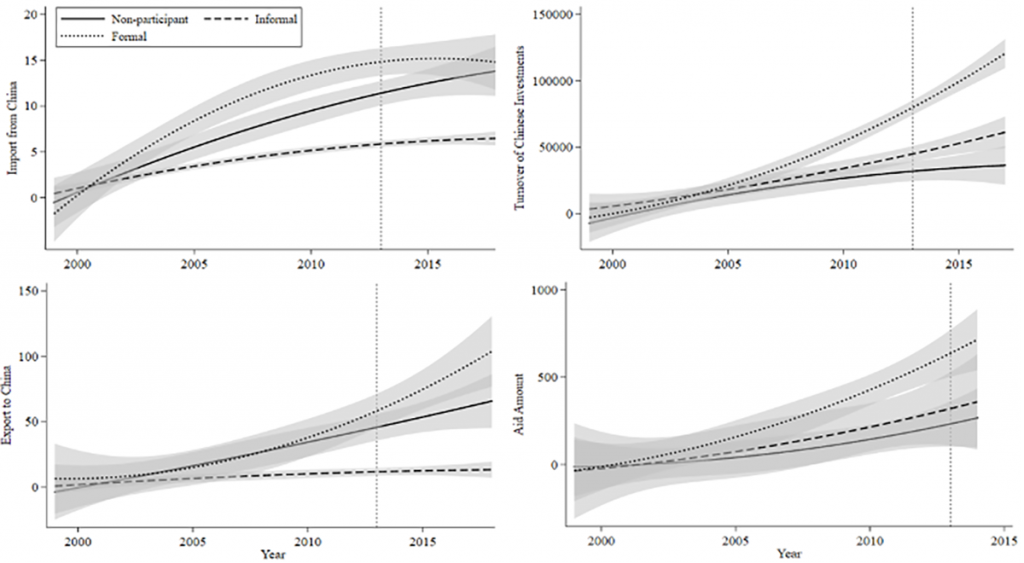

The 'Trends of Chinese economic linkages' graph below plots the four types of economic linkages of other economies with China (imports and exports, indexed to 1 in 1999), across passive (imports/exports) or active (investment/aid) indicators. As you might expect, formal participants lead the other groups. The hypothesised economic surge as a result of the BRI fails to materialise.

Our research finds that participation in the BRI does not have a strong influence on a country's economic linkages with China

The BRI, therefore, does not have a strong impact on a country’s economic linkages with China. This finding does not necessarily mean that China has not spent more effort in cultivating economic ties (as the figures of investments demonstrate). It does show, however, that efforts began long before the BRI launched in 2013.

We chose Hungary and Italy as case studies to examine the dynamics of two medium-sized (in economic terms) EU countries with formal BRI status. Hungary is experiencing democratic backsliding while seemingly embracing tighter connections with China. Thus, it is a case in which the BRI is most likely to exert its effect. Italy, on the other hand, has made high-profile overtures to the BRI. It joined in 2019, much to the world’s surprise.

Both cases show a similar pattern regarding the relative importance of Chinese investments. The increase in the flow of investment was much larger prior to the onset of BRI than after (though Hungary did register a slight decrease). This hints strongly that the BRI's economic effects are limited.

Results of our analysis hint that the BRI's economic effects are limited

Overall, the Hungarian case demonstrates how the BRI is an attractive economic scheme for the Hungarian government. Although not directly related to the BRI, Hungary’s political system has experienced democratic backsliding in recent years, alongside increasing disputes with the EU. Hungary’s involvement in the BRI is concurrent with its international realignment; this reinforces our main argument that China’s BRI is a product of pre-existing international relations.

In contrast, the Italian BRI experience is more complex. For Italy, participation in China’s BRI was a purely economic decision for a succession of coalition governments. When Italy made an official decision to leave the BRI, on 6 December 2023, the project had exerted only limited observable economic effects.

Our mixed-methods approach, analysing over a decade of cross-national data and case studies, presents a novel reassessment of China’s BRI project. We show clearly that the BRI's true economic influence has been more modest than its scale and ambition have often implied.