Thirty years ago, central banks simply did not make transparent public statements. Now, communication with the public and the media is crucial to their operation. Lauren Leek has co-developed an interactive website, Central Bank Talk, which offers users revealing insights into central bank communication across the world, and over time. Here, she presents some of the site's key tools

Central bank communication wasn't always a Thing. In 1987, Federal Reserve Chairman Alan Greenspan explained: 'If I seem unduly clear to you, you probably misunderstood what I said'. Similarly, William Greider named his bestselling 1987 book, which focused on the Federal Reserve, Secrets of the Temple. In other words, before the 1990s, central banks were opaque and secretive.

This all changed in the mid-1990s. Central banks with various levels of independence – in advanced and developing economies, democratic and autocratic – massively increased their levels of communication. Academic and policy attention has since focused on analysing why this sea change took place, and explaining its effects.

Despite the interest from scholars and policy-makers, resources for mapping central bank communication have, until now, been scarce. Simeon Bischl and I set out to correct this. To capture how central banks now routinely use communication tools to move markets and improve their reputation, we analysed all 18,000+ speeches, from 118 central banks, between 1997 and 2023, gathered by the Bank of International Settlements (BIS). We published our findings at CentralBankTalk.eu.

CentralBankTalk.eu analyses 18,000+ speeches, from 118 central banks, between 1997 and 2023

The BIS database contains speeches given by central bank governors, along with policy-relevant speeches by senior central bankers and international monetary institutions. It offers insights into central banks in advanced Western economies, and data from non-Western banks including the State Bank of Pakistan and the Reserve Bank of Malawi. We enriched this database with our own metadata about speakers, speech frequency, audiences addressed, location and topics.

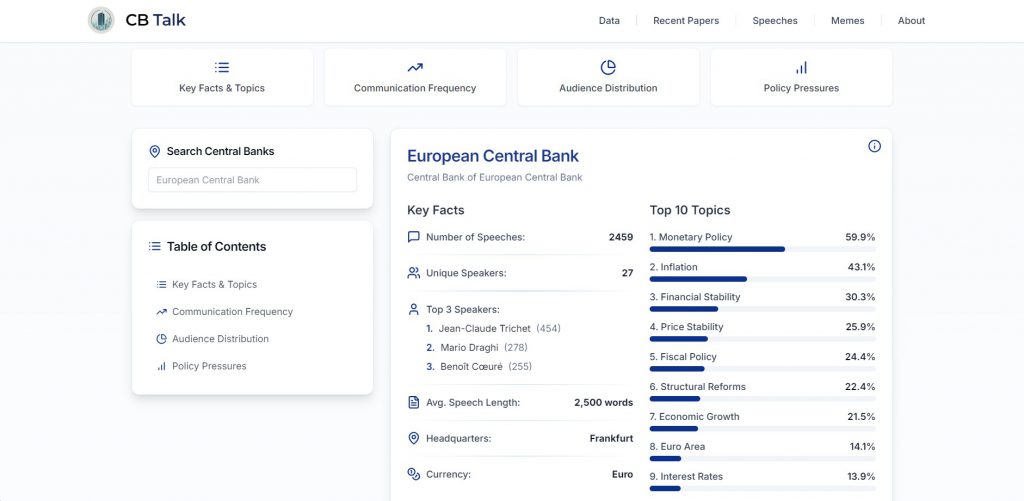

To explore patterns of communication, users can select the Data tab to search for any central bank in the database. They can then see how often a bank issued a speech, its top ten topics, what kind of audience it addressed, and how its governors responded to monetary policy pressures.

Our website allows users to see how frequently central banks give public speeches, what they talk about, and who they talk to

From 1997 to 2023, we see a gradual upward trend in communication frequency. Following the global financial crisis, there is a pronounced spike. The topics central banks discuss varies, but we can see the top ten by prompting Google Gemini, a Large Language Model. Based on those topic descriptions we can calculate high-dimensional vector representations, or 'embeddings'. These capture the semantic and contextual meaning of words from which we derive our more narrow topics.

The most frequently mentioned topics are monetary policy, inflation and unemployment. Yet, over time, speeches venture into new realms such as financial stability and, more recently, the climate, inequality and digital currencies. Curiously, some central bank-specific topics also show up. For instance, the Central Bank of Malaysia's number-one topic is Islamic Finance. For the Bank of Japan, deflation is important.

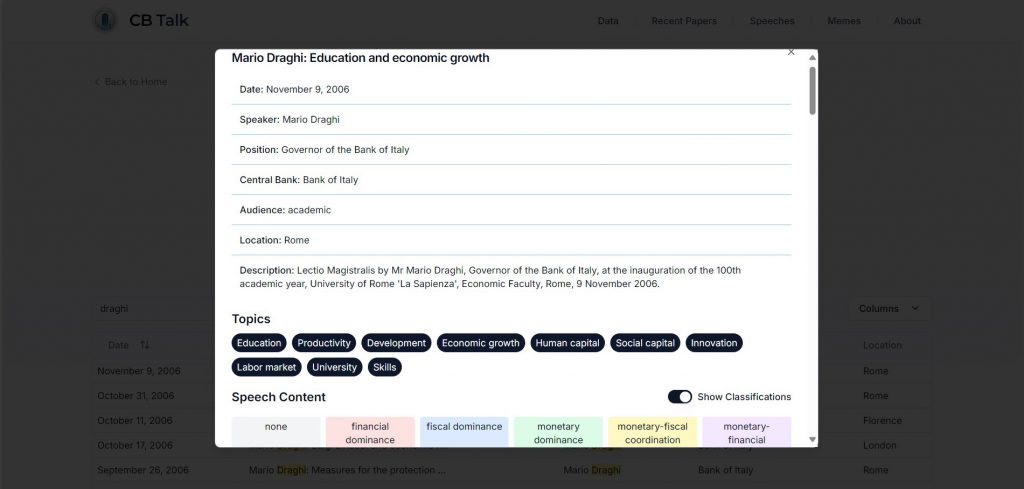

The audiences for these speeches also vary. In 2012, European Central Bank President Mario Draghi gave his famous 'whatever it takes' speech at a conference in London for financial markets and investors. At the time, the eurozone was grappling with a severe sovereign debt crisis, and Draghi's speech calmed the markets.

Central bank speak has also reached Main Street. As the economist Carola Blinder put it: 'it may be time to pay some attention to communication with the general public'. Similarly, as Federal Reserve Chairwoman Janet Yellen explained in 2013: 'The effects of monetary policy depend critically on the public getting the message about what policy will do months or years in the future'. Our website uses the venue of the speech to identify different audiences: academics, a general central banking public, and political and financial audiences.

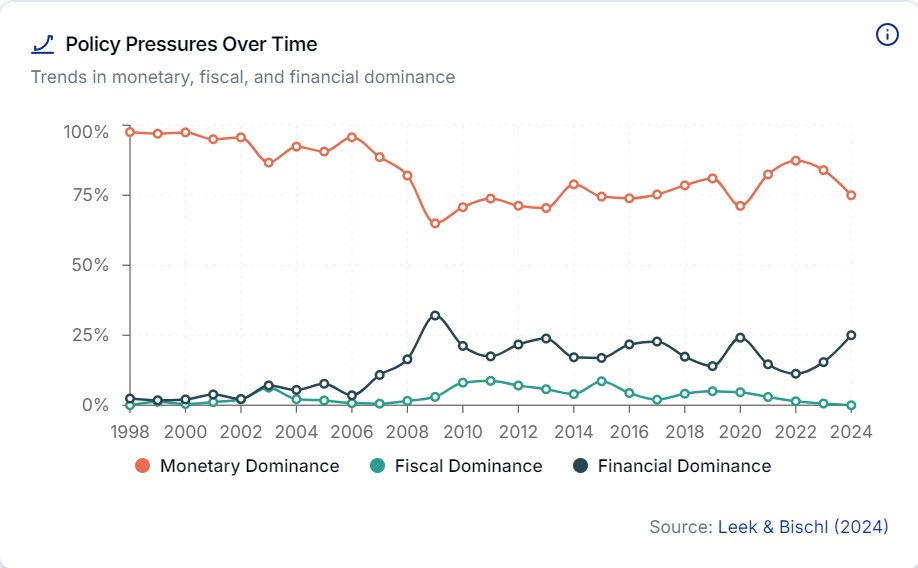

Banks frequently use speeches to respond to pressure. Current Federal Reserve Chair Jerome Powell was recently asked whether he would step down if Donald Trump asked him to. His answer was a firm 'no'. Responses to certain pressures may lead to tangible policy change. Take the recent collapse of Silicon Valley Bank, after which Powell was quickly pressured into issuing a statement in which he announced an adjustment of the bank's guidance on future rate moves.

A key challenge for academics and pundits has been detecting how banks' communications respond to pressure from politicians, the media and the public

Central banks are coming under increasing pressure. The key challenge for academics and pundits has therefore been detecting how banks' communications respond to such pressure. Recent LLM developments offer a solution. Not only are they scalable, but they can also classify complex text about abstract concepts in a highly interpretable way. As our recent work shows, some LLMs are even as good as humans. Our website uses LLM classifications to construct proportional indices of policy pressures per central bank, which we describe in a recent preprint as 'dominances':

Under the Speeches tab, users can explore all speeches and metadata. They can also see our classifications of central bank responses to certain policy pressures, at sentence level. Under ‘show classifications’, different categories appear. This allows the user to see how central banks respond publicly to pressures on their ability to conduct monetary policy.

Not much is left of the once-secretive and opaque central banks. By providing a platform for scholars to explore central bank communication, our website contributes to open democratic debate and institutional transparency.

I read the entire blog, and it’s fascinating to see how central bank communication has evolved from secrecy to transparency over the years. The insights provided about the CentralBankTalk.eu platform are incredibly valuable for understanding the trends, topics, and pressures shaping global monetary policy. At GSPU, we appreciate tools like these that enhance transparency and foster informed decision-making, especially in the financial sector. This blog is a must-read for anyone interested in central banking and economic policy.