Latest polls show that the American public expects inflation to rise – and this is a big problem for Donald Trump. Paul Whiteley describes how it directly affects Trump’s approval ratings and, as inflation cumulates, means that he is likely to become increasingly unpopular as his term continues

Donald Trump’s first-term approval ratings averaged 41%, the lowest of any President since the Second World War. To put this in context, John F. Kennedy, who enjoyed an average approval score of 70% during his short term, achieved the highest postwar rating.

According to a 21 July Economist/YouGov poll, 41% of Americans approve of the President’s performance, and 55% disapprove. Trump currently scores the same as the average in his first term. In that term, his ratings fell from 45% at the start to 34% at the end, so a repeat of this will mean an even lower overall average rating.

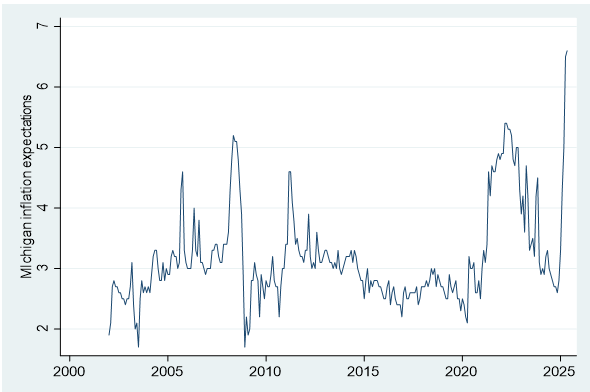

One of the biggest problems Trump faces is a rapid rise in inflationary expectations. In the chart below, a high score means high expectations of inflation in the future. The data, from regular surveys conducted by the University of Michigan, covers the period January 2002 to May 2025. The rapid rise in expectations since Trump took office is by far the largest recorded over this period.

Responses to a question about the most important issue the country faces show that inflation takes the top spot, making it the most salient issue for Americans at the present time. Another question reveals that only 31% of Americans approve of the way the President is handling the problem, while 61% disapprove.

31% of Americans approve of the way the President is handling the problem of inflation, while 61% disapprove

Coping with inflation is the responsibility of the US Federal Reserve. It does this by setting interest rates, trying to balance healthy investment and growth on the one hand by lowering rates, and raising them when inflation threatens.

President Trump believes interest rates are too high, and is pressing Federal Reserve Chairman Jay Powell to lower them. Trump recently derided Powell as a ‘stupid person’ while appearing oblivious to the threat of inflation:

A Fed policy rate that low is not typically a sign that the US is the 'hottest' country in the world for investment, as Trump has said. It is usually a crisis response to an economy in serious trouble

Reuters economic journalist Howard Schneider, accurately summarising the problem

Several factors explain what has boosted inflation expectations in this way. Firstly, the President’s liking for tariffs drives up the prices of goods and services, because tariffs are a tax on imports into the US.

A secondary effect is the fall in the value of the dollar in comparison with other currencies. Since the middle of June, the dollar has been falling in value in relation to the Euro. This raises the price of imports into the US, because consumers have to spend more dollars to get the imports they want.

A third problem arises from the ‘Big Beautiful Budget’ Congress has just passed. The Congressional Budget Office predicts it will raise the budget deficit by $2.4 trillion by 2034. As the country borrows more to cover the deficit, it must raise the rates it pays to lenders. This in turn can produce ‘stagflation’ or a combination of unemployment and inflation because it depresses economic activity and drives up borrowing costs.

Finally, the uncertainty generated by Trump's volatile interventions in the economy, particularly in relation to tariffs, can also generate inflation. This happens when decision-makers in financial markets and in foreign government try to insulate themselves by hedging against a very volatile macroeconomic environment. They buy fewer Treasury bonds, which are loans to the US government, and this raises the cost of borrowing.

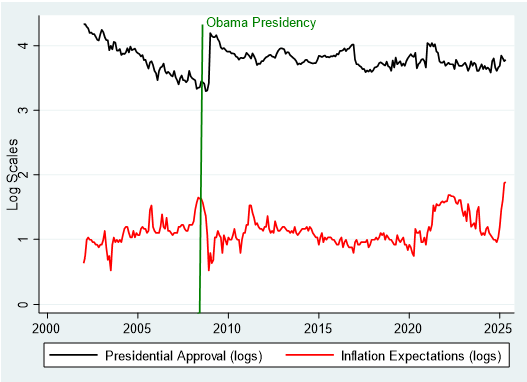

The political risks of inflation for the President arise from the fact that inflation expectations – which are driven by actual inflation – are related to presidential job approval ratings. The chart below compares the two measures. They are expressed in logarithms, which does not change their relationship, but makes it easier to see what is happening.

When inflationary expectations fall, presidential job approval increases, and vice versa

The correlation between job approval and inflationary expectations is -0.34, which is a moderate though highly significant association. When inflationary expectations fall, presidential job approval increases, and vice versa. We saw this relationship most clearly when Barack Obama took over from George W. Bush in January 2009. The latter suffered from the financial crash of 2008, so the election of a new President rapidly reduced inflationary expectations as well as increasing support for the new incumbent.

It is noticeable that the current rapid rise in inflationary expectations does not appear to have affected President Trump’s job approval ratings yet, although they have been declining at a steady rate since he took office.

The main reason for this is that presidential approval reacts to expectations after a time lag. We can see this by looking at the correlation between Trump’s current approval ratings and expectations lagged three months earlier. The correlation is -0.44: considerably stronger than the contemporary correlation. The effects of rising inflationary expectations cumulate over several months.

This means that if inflationary expectations continue to remain high, which seems very likely, the impact on the President’s job approval ratings will be most apparent in September/October of this year.